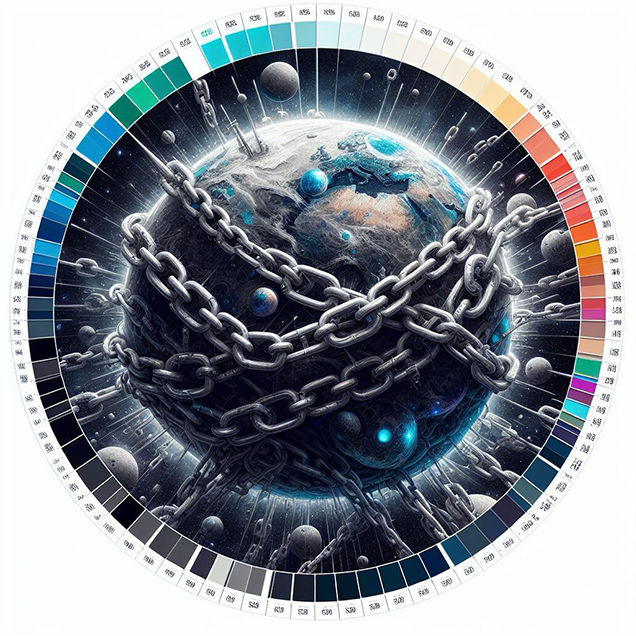

How the Global Economy became weaponized against the worlds original indigenous populations

Unveiling Economic Oppression: How Black Communities Have Been Disadvantaged by the Economic Machine

Introduction:

In dissecting the intricacies of the economy, it becomes evident that beyond the conventional forces of productivity growth and debt cycles lies a deeper and more insidious reality: economic oppression. For centuries, black communities have been subjected to systemic discrimination and marginalization within the economic system, perpetuating cycles of poverty and hindering opportunities for advancement. This article aims to shine a light on how the economic machine has been weaponized against black people, exacerbating inequalities and thwarting progress.

Historical Context:

The roots of economic oppression against black communities run deep, stemming from the era of slavery and continuing through centuries of segregation and discrimination. During slavery, black individuals were denied basic economic rights, forced into labor without compensation, and treated as commodities to fuel the economic prosperity of white slave owners. Even after emancipation, systemic barriers such as Jim Crow laws and redlining policies restricted black access to housing, employment, and financial services, further entrenching economic disparities.

Modern-Day Manifestations:

Despite advancements in civil rights and anti-discrimination legislation, economic oppression against black communities persists in various forms. Redlining, the practice of denying loans and financial services to predominantly black neighborhoods, continues to limit access to credit and perpetuate cycles of poverty. Studies have shown that black individuals are disproportionately denied loans and charged higher interest rates, even when controlling for factors such as income and creditworthiness. This systemic discrimination hampers wealth accumulation and economic mobility for black families, widening the racial wealth gap.

Intersectionality:

Economic oppression intersects with other forms of oppression, compounding the challenges faced by black communities. Gender, for example, further exacerbates economic disparities, with black women experiencing higher rates of unemployment, wage discrimination, and wealth inequality compared to their white counterparts. Additionally, the criminal justice system disproportionately targets black individuals, resulting in mass incarceration and barriers to employment and housing upon release, perpetuating cycles of poverty and economic disenfranchisement.

Breaking the Cycle:

Addressing economic oppression requires a multi-faceted approach that tackles systemic inequalities and promotes economic empowerment within black communities. Mending Cycle Goals, aimed at providing access to capital sources and flattening out each type of poverty wave, offer a holistic strategy for ending poverty and fostering sustainable economic growth. By dismantling systemic barriers, investing in education and job training, and supporting black-owned businesses and entrepreneurship, we can work towards creating a more equitable and just society for all.

Conclusion:

The weaponization of the economic machine against black communities has perpetuated cycles of poverty and hindered opportunities for advancement. By acknowledging and confronting systemic discrimination and inequality, we can begin to dismantle the structures that perpetuate economic oppression and work towards a future where all individuals, regardless of race or background, have equal access to economic opportunities and prosperity.

How to Set Mending Goals: A Step-by-Step Guide (with Examples)

How to Set Mending Goals: A Step-by-Step Guide (with Examples)

Empowering Global Africa’s Farmers: A Private Modern Land Grant Platform

Empowering Global Africa’s Farmers: A Private Modern Land Grant Platform

Unicorn impact investors: Modeling Work Life Balance for Underserved and Underdeveloped Populations.

Unicorn impact investors: Modeling Work Life Balance for Underserved and Underdeveloped Populations.